PRIVACY POLICY

MST Lending ("we," "us," "our," or "Company") is committed to protecting the privacy and security of your personal information. This Privacy Policy explains how we collect, use, share, and protect your personal information when you apply for or obtain financial services from us, visit our website, or otherwise interact with our services.

This Privacy Policy applies to all personal information we collect about you as a consumer, whether you become a customer or not. We are required by law to provide you with this notice to explain our privacy practices.

IMPORTANT: This Privacy Policy is provided in compliance with the Gramm-Leach-Bliley Act (GLBA), the Fair Credit Reporting Act (FCRA), and other applicable federal and state privacy laws.

INFORMATION WE COLLECT

Personal Information We Collect

We collect personal information about you from various sources to provide you with lending services. The types of personal information we collect may include:

Information You Provide to Us:

Contact information (name, address, phone number, email address)

Social Security number and date of birth

Employment and income information

Financial information (bank accounts, assets, debts, payment history)

Information from loan applications and supporting documents

Information from communications with us (calls, emails, letters)

Identification documents (driver's license, passport, etc.)

Information We Obtain from Other Sources:

Credit reports and credit scores from credit reporting agencies

Information from employers, financial institutions, and other creditors

Public records (property records, court records, etc.)

Information from fraud prevention services

Information from marketing companies and data brokers

Information from government agencies

Information We Collect Automatically:

Website usage information (IP address, browser type, pages visited)

Device information (mobile device ID, operating system)

Location information (when permitted by your device settings)

Cookies and similar tracking technologies

Sensitive Personal Information

We may collect sensitive personal information, including:

Social Security numbers

Financial account numbers

Credit and debit card information

Biometric information (where permitted by law)

Information about your creditworthiness

HOW WE USE YOUR INFORMATION

We use your personal information for legitimate business purposes, including:

Lending Services

Processing and underwriting loan applications

Verifying your identity and income

Determining your creditworthiness

Originating, funding, and servicing loans

Managing your account and collecting payments

Communicating with you about your loan

Legal and Regulatory Compliance

Complying with federal and state lending laws

Reporting to credit bureaus and government agencies

Preventing fraud and identity theft

Conducting background checks and verifications

Maintaining records as required by law

Business Operations

Improving our products and services

Marketing and advertising our services

Analyzing website usage and customer behavior

Training our employees

Managing business relationships

INFORMATION SHARING PRACTICES

We may share your personal information with third parties in the following circumstances:

With Your Consent

We may share your information when you provide explicit consent or direction to do so.

Service Providers and Business Partners

We may share your information with third parties who provide services to us or on our behalf, including:

Credit reporting agencies

Loan servicing companies

Payment processors

Technology service providers

Marketing and advertising partners

Legal and professional service providers

Loan origination system providers

Legal Requirements

We may share your information when required by law, including:

In response to subpoenas, court orders, or legal process

To comply with regulatory examinations

To report to government agencies as required

To investigate or prevent illegal activities

To protect our rights and property

Business Transactions

We may share your information in connection with business transactions, such as:

Sale or transfer of loans

Mergers, acquisitions, or asset sales

Bankruptcy or insolvency proceedings

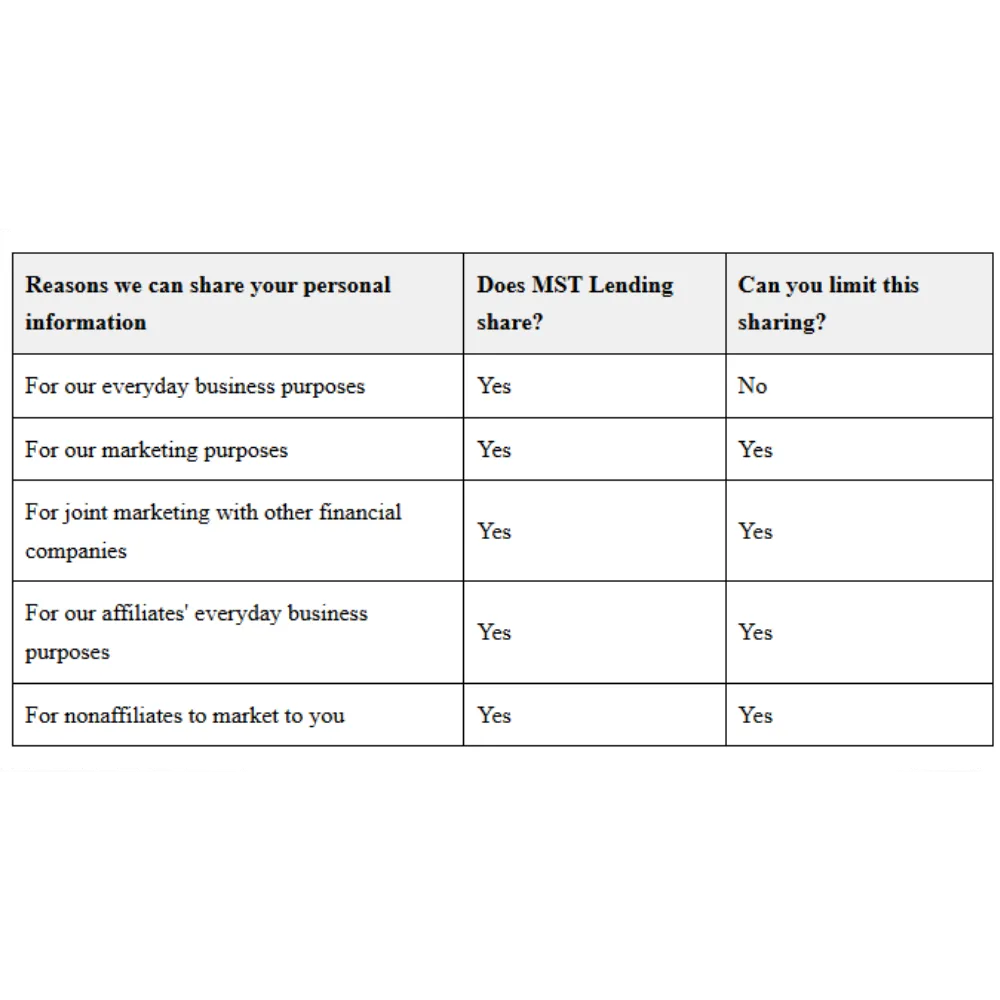

Information Sharing Table

YOUR PRIVACY RIGHTS AND CHOICES

Right to Opt Out

You have the right to limit some but not all sharing of your personal information. You can opt out of:

Sharing for marketing purposes

Sharing with affiliates for their marketing purposes

Sharing with nonaffiliates for their marketing purposes

How to Exercise Your Rights

To exercise your opt-out rights, you may:

Call us at (888) 272-8264

Email us at [email protected]

Write to us at 812 Huron Rd E, Suite 719, Cleveland, OH 44115

Visit our website at mstlending.com

State-Specific Privacy Rights

California Residents

If you are a California resident, you have additional rights under the California Consumer Privacy Act (CCPA), including:

Right to know what personal information is collected

Right to know whether personal information is sold or disclosed

Right to opt out of the sale of personal information

Right to access personal information

Right to equal service and price

Other State Rights

Residents of other states may have additional privacy rights under applicable state laws. Please contact us for more information about your state-specific rights.

Credit Reporting Rights

You have rights regarding your credit information, including:

Right to obtain a free credit report annually

Right to dispute inaccurate information

Right to place fraud alerts or credit freezes

Right to opt out of prescreened credit offers

SECURITY MEASURES

Information Security Program

We maintain a comprehensive information security program designed to protect your personal information. Our security measures include:

Administrative Safeguards:

Security policies and procedures

Employee training and background checks

Access controls and user authentication

Incident response procedures

Regular security assessments

Technical Safeguards:

Encryption of data in transit and at rest

Firewalls and intrusion detection systems

Secure network architecture

Regular software updates and patches

Multi-factor authentication

Physical Safeguards:

Secure facilities and data centers

Access controls and visitor management

Secure disposal of physical records

Environmental controls

Data Breach Response

In the event of a data breach that affects your personal information, we will:

Investigate the incident promptly

Notify affected individuals as required by law

Notify regulatory authorities as required

Take steps to prevent future incidents

DATA RETENTION

We retain your personal information for as long as necessary to:

Provide you with lending services

Comply with legal and regulatory requirements

Resolve disputes and enforce agreements

Protect our legitimate business interests

Generally, we retain loan-related information for at least seven years after the loan is closed or as required by applicable law. We may retain some information for longer periods when required by law or for legitimate business purposes.

THIRD-PARTY WEBSITES AND SERVICES

Our website may contain links to third-party websites or services. This Privacy Policy does not apply to those third-party websites or services. We encourage you to review the privacy policies of any third-party websites or services you visit.

We are not responsible for the privacy practices or content of third-party websites or services.

CHILDREN'S PRIVACY

Our services are not intended for individuals under the age of 18. We do not knowingly collect personal information from children under 18. If we become aware that we have collected personal information from a child under 18, we will take steps to delete that information.

UPDATES TO THIS PRIVACY POLICY

We may update this Privacy Policy from time to time to reflect changes in our practices or applicable law. When we make material changes to this Privacy Policy, we will:

Post the updated Privacy Policy on our website

Update the "Last Updated" date

Provide notice to you as required by law

We encourage you to review this Privacy Policy periodically to stay informed about our privacy practices.

CONTACT INFORMATION

MST Lending Contact Information

Mailing Address:

MST Lending

812 Huron Rd E Suite 719

Cleveland, OH 44115

Phone: (888) 272-8264

Email: [email protected]

Website: www.mstlending.com

Privacy Officer:

Chad Bucceri

Manager

If you have questions about this Privacy Policy or our privacy practices, please contact us using the information above. We will respond to your inquiry promptly.

REGULATORY COMPLIANCE

Federal Laws

This Privacy Policy is designed to comply with applicable federal laws, including:

Gramm-Leach-Bliley Act (GLBA)

Fair Credit Reporting Act (FCRA)

Equal Credit Opportunity Act (ECOA)

Fair Debt Collection Practices Act (FDCPA)

Truth in Lending Act (TILA)

Real Estate Settlement Procedures Act (RESPA)

State Laws

We also comply with applicable state privacy laws, including state data breach notification laws and consumer protection statutes.

Regulatory Oversight

Our privacy practices are subject to examination by various regulatory agencies. We maintain appropriate policies and procedures to ensure ongoing compliance with applicable privacy laws and regulations.

Connect With Us

Contact Customer Service

Toll Free: (888) 272-8264

NMLS #407536

MST Lending

812 Huron Rd E, Suite 719

Cleveland, OH 44115

Legal Information & Links